MA Form PC is an annual filing requirement for public charities operating or soliciting funds in Massachusetts. It ensures compliance with state regulations and transparency in charitable activities.

Filing Requirements and Eligibility for MA Form PC

Public charities in Massachusetts must file Form PC annually. Eligibility includes organizations operating or soliciting funds in the state, with exemptions for religious property holders and certain federally chartered groups.

Who Needs to File Form PC

Public charities organized or operating in Massachusetts, or soliciting funds within the state, are required to file Form PC. This includes nonprofits conducting business or fundraising activities in MA, regardless of their primary location. Organizations holding property for religious purposes or certain federally chartered groups are exempt. Charities must ensure they meet the eligibility criteria outlined by the Massachusetts Attorney General’s Office to determine if filing is necessary. Failure to comply may result in penalties, emphasizing the importance of understanding filing obligations.

Exemptions from Filing Form PC

Certain organizations are exempt from filing Form PC in Massachusetts. These include religious groups holding property exclusively for religious purposes and federally chartered organizations. Additionally, charities that submit a probate account to the court or file IRS Forms 990, 990EZ, or 990PF may be exempt. However, they must still attach financial statements to their Form PC if required. Exemptions are outlined by the MA Attorney General’s Office, and organizations must verify their eligibility to avoid unnecessary filings. Understanding these exemptions ensures compliance and avoids potential penalties for failure to file when not required.

Online Portal Registration and Submission Process

The online portal registration and submission process for MA Form PC requires organizations to create an account on the Nonprofit Organizations/Public Charities Division portal. Once registered, charities must prepare and submit Form PC along with required financial statements. The process involves uploading the completed form and supporting documents through the portal. After submission, two authorized representatives of the organization must review and electronically sign the form. The portal streamlines the filing process, reducing paperwork and ensuring compliance with Massachusetts regulations. Organizations should allocate time for this process, as it may require additional steps and verification. Proper submission ensures timely approval and avoids penalties.

Recent Changes to Form PC Filing Process

Massachusetts has transitioned Form PC filing to an online portal, requiring electronic submission and two authorized signatories. Additional steps and fees may apply for complex filings.

Transition from Paper to Online Filing

The state of Massachusetts has mandated a shift from traditional paper-based submissions to an online platform for Form PC. This change aims to streamline the filing process, enhance efficiency, and improve transparency. Charities must now register on the Massachusetts Attorney General’s Office (AGO) Charity Portal to submit their annual filings electronically. Organizations are required to create an account, complete the form online, and have two authorized representatives review and sign the document within the portal. This transition eliminates the need for paper-based submissions and ensures that all filings are processed digitally, aligning with modern regulatory standards and reducing administrative burdens. The online system also offers improved tracking and communication features.

Key Changes in the Filing Process

Recent updates to the MA Form PC filing process include mandatory electronic submission through the AGO Charity Portal. Organizations must now register and create an account to access the system. The portal requires two authorized representatives to review and electronically sign the form. Additionally, the previous paper-based Form PC is no longer accepted and cannot be uploaded as a substitute. The filing process now includes enhanced document upload capabilities and improved tracking features. These changes aim to modernize the system, reduce errors, and ensure compliance with state regulations. Organizations must adapt to these updates to avoid delays or penalties in their annual filings.

Impact on Charitable Organizations

The transition to the online filing system for MA Form PC has introduced significant changes for charitable organizations. The mandatory use of the AGO Charity Portal requires organizations to register and maintain accurate accounts, adding administrative tasks. The need for two authorized representatives to electronically sign the form ensures accountability but may slow down the process for some groups. Smaller charities, particularly those with limited technical resources, may face challenges adapting to the new system. However, the digital process improves transparency and reduces errors, benefiting organizations in the long run. Compliance with these changes is crucial to avoid penalties and maintain operational continuity in Massachusetts.

Preparing for Form PC Submission

Review instructions, gather financial records, and ensure all information is accurate before starting the online form to streamline the submission process effectively.

Gathering Necessary Documents

To complete Form PC accurately, organizations must gather essential documents, including financial statements, governing documents, and detailed records of charitable activities. Ensure all information is up-to-date and precise. For organizations exempt from filing Federal Form 990, attaching financial statements is mandatory. Properly organizing these documents beforehand streamlines the submission process and prevents delays. Reviewing the specific requirements outlined in the instructions ensures compliance and avoids potential issues during the filing process.

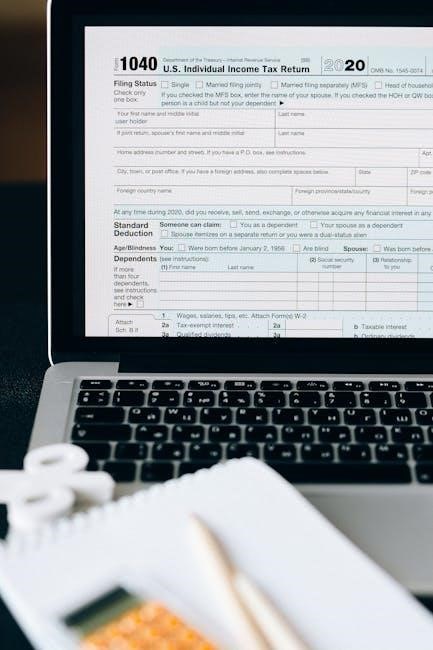

Understanding the Form and Instructions

Understanding Form PC and its instructions is crucial for accurate and timely filing. The form requires detailed financial disclosures, governance policies, and descriptions of charitable activities. Review the instructions thoroughly to grasp the specific data needed, such as revenue sources, expenses, and board member information. Pay attention to sections about compliance with state regulations and transparency standards. Organizations must ensure all information aligns with their mission and financial records. Familiarizing yourself with the form’s structure and requirements helps prevent errors and ensures compliance with Massachusetts charity laws. Proper understanding also aids in completing the form efficiently and accurately.

Submitting and Reviewing Form PC

Submitting Form PC involves online portal submission, requiring two organizational members to review and sign. Additional costs range from 1 to 3 hours. Paper filings are no longer accepted, ensuring compliance with updated regulations.

Step-by-Step Submission Process

The submission process begins with registering on the Massachusetts Attorney General’s Charity Portal. Once registered, prepare Form PC by filling it out online. Submit the form through the portal, ensuring all required fields are completed. After submission, two authorized representatives must review and electronically sign the form. The portal will guide users through each step, and once signed, the form is automatically submitted for review. Organizations should allow time for processing and ensure compliance with all requirements to avoid delays. Paper filings are no longer accepted, so all submissions must be completed digitally through the portal.

Review and Approval Process

After submitting Form PC, the Massachusetts Attorney General’s office reviews it for completeness, accuracy, and compliance with state regulations. The review process ensures that all required information is provided and that the organization meets the necessary standards. If the submission is complete and accurate, the form is approved, and the organization receives confirmation. If issues are identified, the office may request additional documentation or corrections. The review process typically takes several weeks, depending on the complexity of the filing. Organizations are encouraged to submit their forms well in advance of deadlines to allow time for processing and any potential follow-up. Approval confirmation is provided electronically through the portal.

Compliance and Support

Compliance with Form PC requirements is essential for maintaining legal status and public trust. Charities must adhere to state regulations and submit accurate documentation.

Support resources, such as instructional guides and expert assistance, are available to help organizations navigate the filing process and ensure compliance effectively.

Importance of Compliance

Compliance with MA Form PC is crucial for maintaining legal status and public trust. It ensures transparency in financial operations and adherence to state regulations. Failure to comply can result in penalties, fines, or even loss of tax-exempt status. Accurate and timely submissions demonstrate accountability to donors and stakeholders. Additionally, compliance helps prevent legal issues and maintains the organization’s reputation. Charities must stay informed about filing requirements and deadlines to avoid non-compliance. Proper documentation and adherence to guidelines are essential for smooth operations and continued charitable work in Massachusetts.

Seeking Help and Resources

For assistance with MA Form PC, organizations can access resources from the Massachusetts Attorney General’s Office. The official website provides detailed instructions, guides, and FAQs. Additionally, nonprofits can contact the Nonprofit Organizations/Public Charities Division directly via email or phone for clarification. Workshops and webinars are often available to help navigate the filing process. Utilizing these resources ensures accurate submissions and avoids delays. Organizations are encouraged to reach out early to address any questions or concerns, ensuring compliance and smooth operations. Help is readily available to support charitable organizations in meeting their obligations effectively.